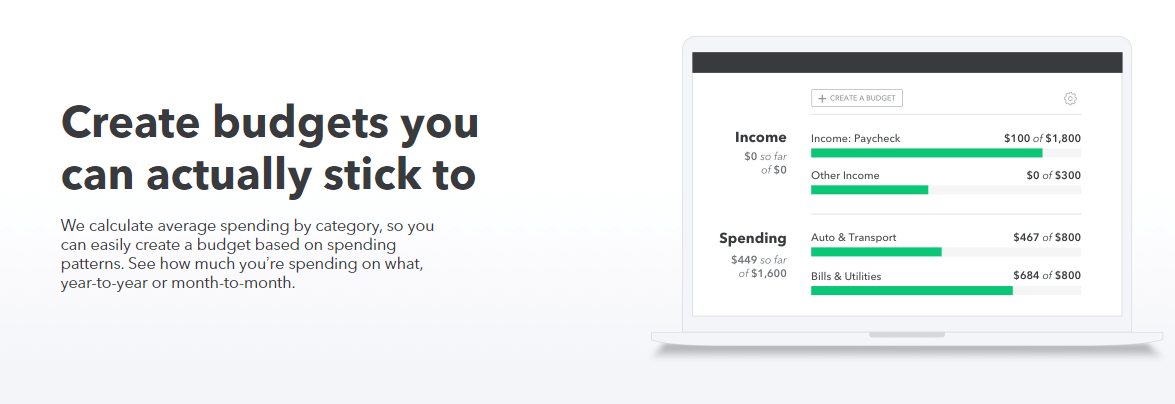

You can then set a total monthly budget, categorize expenses, track your spending by category, and monitor your credit score. You'll need to download the app and sign up for an account to use its features. It's useful because it can teach you to save money more effectively while also helping to improve your financial literacy. The Mint budgeting app connects with your financial accounts, so users can get a clear picture of their financial health and total debt within the app. You can also set category-specific budgets and savings goals. Developed by Intuit, Inc, this mobile app is a budgeting tool that lets users manage and track their spending. Note: For more information on the PFM space, see our Online Banking Report on Personal Finance Features.Mint is a free personal finance app that makes it easy to manage and save money. The interesting question for 2010: Now that Mint is part of the establishment, what startup will rise up to challenge it? Or will the banks, back on a path to profitability, fill the need going forward?Ĭhart 1: Mint’s traffic is now similar to Intuit’s non-tax-time trafficĬhart 2: Mint now has about the same number of visitors as the tenth largest U.S. That gives you a little understanding of why Intuit coughed up $170 million for the startup.Īnother way to look at it: Mint now has as much traffic as the tenth largest U.S. to April tax-time traffic spike at Intuit, Mint’s traffic is now slightly HIGHER than that of its parent company ( see chart #1 below).

To provide a little context, not counting the Dec. According to Compete, in January, Mint had 1.7 million unique visitors, 600,000 more than a year earlier. I don’t know if it has anything to do with the publicity Mint received in recent months following its acquisition by Intuit or the promotional links from Quicken’s website, but the online PFM juggernaut just blew the roof off its monthly traffic.

0 kommentar(er)

0 kommentar(er)